Group Retirement Plan Services

Group Retirement Plan Services

Enjoy the Freedom

If you’ve ever thought about offering your business owner and executive clients group retirement plan services, now is the perfect opportunity to do so. Through our Group Retirement Plan Services, Freedom Advisors provides the resources, tools and support in partnership with some of the most recognized plan service providers.

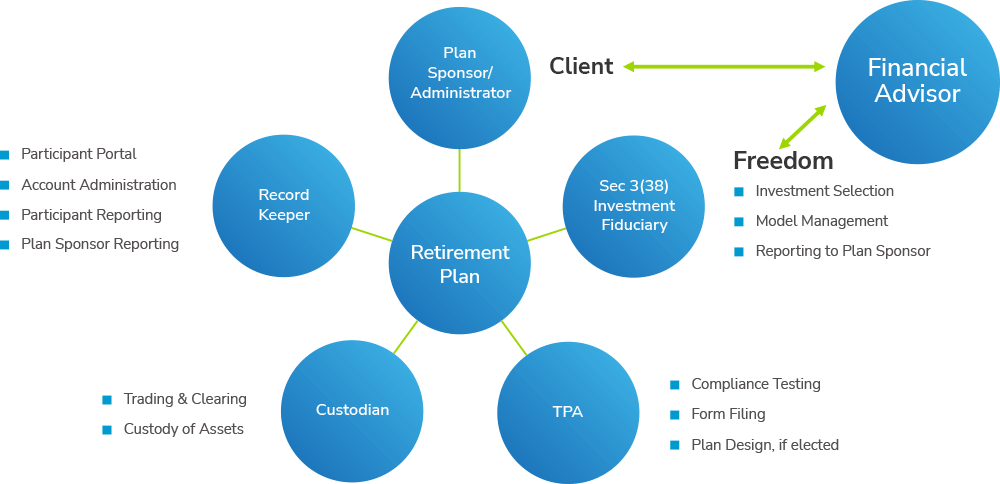

How It Works

Freedom and Our Plan Administration Partners Support Your Retirement Plan Business

Easy Plan Design and Setup

We support all defined contribution and defined benefit plan types and offer a wide range of retirement plan services.

- Plan Types – 401(k), 401(a), 403(b), Defined Benefit, and more

- Responsive Plan Design – Safe harbor, traditional, Roth

- Plan Transition Manager – A dedicated plan transition manager or team will be assigned and available throughout the process

Expansive, Flexible Investments and Fiduciary Services

- Managed models, active and passive funds, ETFs and CITs

- Accessible investment professionals, not a robo-solution

- Section 3(38) investment management fiduciary relieves the plan sponsor and advisor from investment selection, monitoring responsibility and the liability associated with investment management

Robust Plan Sponsor Services

- Freedom acts as ERISA 3(38) Investment Manager

- Payroll integration to streamline employer duties

- Expert assistance for plan sponsors

- Associated HSA and plan add-on options available

Comprehensive Plan Administration and Compliance

- Extensive Selection of Payroll System Integrations

- Plan Custody and Trading

- In-Depth Reporting

- Modern Efficient Technology

- Competitive and Transparent Fees

Ongoing Support and Education

- Advisor-Centric Consulting and Support Team

- Dedicated Service Teams

- Participant Support and Education

- Personalized Communications

Freedom Operates as a 3(38) Investment Manager

Section 3(38) is an “investment manager” and by definition is a fiduciary because they take discretion, authority and control of the plan’s assets. ERISA provides that a plan sponsor can delegate the significant responsibility (and significant liability) of selecting, monitoring and replacing of investments to the 3(38)-investment manager fiduciary.

- Individual Investment Options:

- Active funds, passive funds/ETFs, CITs, stable value

- Model management

- Managed accounts through actively managed CITs*

- We DO take plan sponsor likes, dislikes and inputs into account when selecting investment options

Freedom’s Risk-Based and Target Date Portfolios

Freedom serves as a “discretionary investment manager” (i.e. an ERISA 3(38) fiduciary) on assets in its portfolios. As such, Freedom specializes in creating and managing model portfolio investment options that reflect appropriate asset allocations, or target retirement dates, for participants with differing risk tolerances and investment time horizons. Diversification and cost-control are achieved by utilizing low-cost exchange-traded funds (ETFs) from leading providers. Through Freedom’s managed models, branded 3D Global Portfolios, we combine different ETFs into a single portfolio, with the objective of delivering consistent portfolio return over time to help plan participants and minimize personal liability of plan fiduciaries.

Whether advisors specialize in retirement plans, or they are only a small portion of their business, Freedom has a solution.

Investment Education

From fund evaluations to fact sheets and model management methodology, we will provide the advisor support, tools and materials to enable clear and concise investment education sessions with plan participants.

Fee Schedule

- Freedom as Plan 3/(38): 0.25% on plan assets

- Freedom as Model Manager: Varies based on method of delivery, platform and strategy type

Record Keeping Partners