EQIS Investment Portfolio Models

EQIS Models

EQIS Models cover the spectrum of asset classes to offer broad market exposure as well as more narrowly focused strategies covering more specialized asset classes or tactical approaches.

Our investment portfolio models offer a wide range of objective-based performance designs:

Created using a proprietary quantitative

modeling process

Strategies diversified across asset class,

geography, market cap, style, and issuer

Complete with due diligence of

sub-advisers

Consistent, structured rebalancing

performed by the Freedom investment team

We use a consistent, step-by-step process to build portfolios to match your clients’ needs.

Macro Economics & Capital Market Assumptions

- Research on economic and market conditions

- Evaluation of stocks relative to bonds and alternatives

- Assessment of 22 sub-asset classes

Set Allocation Targets

- Resulting asset class weights

- Adjusted cap and style targets

- Adjusted domestic international exposure

Due Diligence & Selection

- Exacting vetting process on money managers

- Deliberate selection of complementary, low correlation strategies

- Manager diversification & blended portfolios may reduce risk without sacrificing returns

EQIS Portfolio Construction

- Adjust target weights to accommodate manager selection

- Verify and test allocations

- Evaluate risk exposure

- Fractional shares bring broad diversification at $25,000

Understand Our Due Diligence Process

Choose from 55 EQIS Models

EQIS UMA Models

EQIS Unified Managed Accounts (UMAs) are portfolios composed of a mix of professional sub-advisers with complementary investment strategies aggregated and managed in one account. These may include individual equities, mutual funds, and exchange-traded funds.

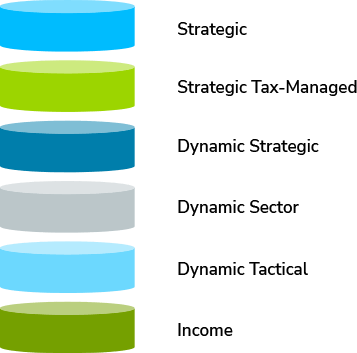

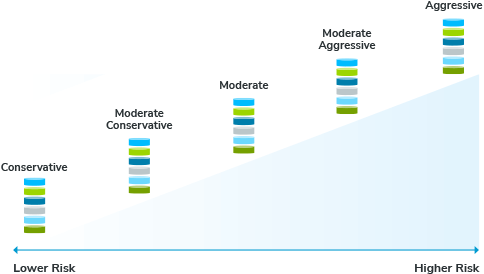

30 UMA model portfolios offer 6 different investment approaches across all 5 risk categories.

EQIS ETF Models

25 single-sleeve EQIS models consisting of exchange traded funds (ETFs) are portfolios of diversified, complementary investment strategies aggregated and managed in one account, tax-efficient and potentially lower cost.

Models that Span the Risk Spectrum

We vet and partner with boutique and specialty institutional sub-advisers. We then mix and match these managers’ strategies across a spectrum of portfolios designed around different strategies and risk profiles, creating the EQIS unified managed account.

Complementary Money Manager Strategies

Freedom carefully selects from the hundreds of sub-asset class strategies available on the Freedom Advisors platform complementary portfolio strategies that together create a highly diversified, purposeful portfolio.

Choice

Advisors and clients get access to a broad array of portfolio models across the risk spectrum and many disciplines, including strategic and tactical, as well as hedging strategies.

EQIS Model Offerings - No-Fee vs Fee

In addition to the extensive search, research, due diligence, selection, and ongoing curating of the expansive Freedom Advisors Model Marketplace, a core set of 55 multi-sleeve and single-sleeve EQIS Models are included as part of the Freedom Platform Fee with no Investment Management Fee, aside from any third-party SMA manager fees and operating expenses of pooled vehicles that are included in some models. Additionally, Freedom provides asset class exposure through one or two ticker models at no additional fee.

Freedom also functions as a money manager for dozens of asset class-focused portfolios made available for advisors to include in Advisor-Built Models, for which Freedom typically imposes a charge of 0.15%. If the Freedom Investment Committee incorporates any of these EQIS managed portfolios as sleeves in the EQIS Models, the 0.15% fee is waived.

The Power of Fractional Shares

Our Four Pillars of Diversification

Freedom believes that multiple layers of diversification may better allow investors to reach their investment objectives and long-term goals while giving them a smoother ride along the way. Purposeful diversification can help investors remain committed to their investment objectives and long-term goals. We believe the following four pillars of diversification are foundational. They are the driver of our constant search for compelling institutional sub-advisers, and the structural backbone of our EQIS UMA and ETF Models.

Asset Classes

Freedom combines multiple individual asset class strategies in each portfolio, which may include stocks, bonds, cash, real estate, precious metals, and other alternatives.

Geographic Regions

Further diversification across multiple regions, countries, and economies may enhance the portfolio’s allocation.

Equity Styles

Equity investments range in market capitalization, style, and factor exposures which fall in and out of favor over time. Predicting which combination is likely to outperform is difficult. That’s why including a variety of styles in a portfolio is important.

Investment Philosophy

Some sub-advisers are strategic and trade infrequently, while others are tactical and can trade more actively when they sense market conditions warrant it. Diversification across investment philosophies can be a distinct differentiator over full market cycles.

Our Rigorous Due Diligence

Experienced Team of Highly Skilled Professionals

Today’s investment environment includes increasing challenges that can be difficult to address without dedicating substantial resources, staff, systems, and investment expertise. As the market becomes ever more complex and individual resources continue to be pressured, the EQIS Models help advisors by taking on responsibility for day-to-day investment portfolio model decision making.

With an experienced team of highly skilled professionals, Freedom delivers full-service asset management solutions. We are proud to offer an institutional and systematic approach to each aspect of the investment process. From dedicated due diligence, asset allocation and capital market research, portfolio management, and portfolio operation specialist teams, the Freedom investment team is focused on the investment portfolio so you can focus on your clients and your business.

At Freedom, we believe every investor deserves the same access to investment opportunities and risk protections.

The average investor has typically been able to achieve broad diversification only through the use of pooled investment vehicles such as mutual funds and exchange traded funds, while the high-net-worth investor has had access to more investment instruments, strategies and programs. That changed many years ago when Freedom revolutionized access, providing investors large and small highly diversified multi-manager portfolios consisting primarily of individual securities. With institutional account minimums typically starting at $500,000 or more and highly diversified multi-manager portfolio minimums requiring $5 million or more, smaller investors have historically been barred from access to this investment management style. Freedom makes it possible through fractional share technology* and advanced portfolio design and construction techniques for investors with as little as $25,000 to access the same sophisticated investment strategies as high net worth investors.

* Fractional shares are not available at every custodian.