Lee Adaptive Large Cap Sector Strategy

Lee Adaptive Large Cap Sector Strategy

Lee Adaptive Large Cap Sector Strategy (“Lee Adaptive”) is a U.S.-only equity strategy that seeks to avoid exposure to severe market downturns while participating in up markets using an adaptive, proprietary quantitative model that adjusts its strategy and positioning as the tenor of markets evolve.

Goal

Lee Adaptive seeks to mitigate severe market drawdowns, which can be detrimental to wealth creation, getting out of harm’s way by exiting certain equity sectors or, at times, equities altogether, adhering to a dynamic, proprietary quantitative model that generates daily scores for each investment.

Process

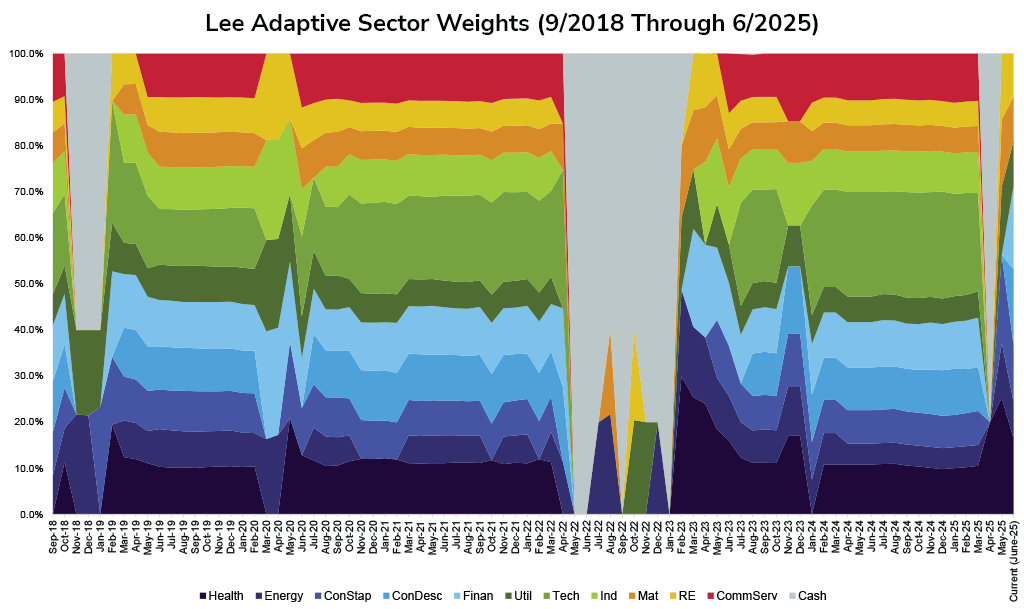

The strategy is implemented with liquid large cap sector ETFs and cash. Sector calls are driven by an adaptive quantitative investment engine that seeks to avoid significant loss. Sectors are either fully owned or not owned, depending on outlook. During usual market environments the portfolio typically owns most or all sectors. In times of stress, Lee Adaptive may hold fewer sectors, and potentially hold up to a 100% cash position, as it did at times in 2022.

Factors

The model incorporates an array of factors and time-tested quantitative techniques that adapt to the current market environment. Negatively scoring sectors are eliminated from the portfolio. Scores above a threshold are considered more likely to gain than lose value and will be held in the portfolio.

Scoring

A series of market factors and sector specific factors combine to produce sector scores. Ultimately, what drives investment decisions is the proprietary Lee Adaptive Sector Score.

We View Risk Differently

We know:

- Over the long term, US equity markets have tended to increase in value and that has been a fundamental source of wealth creation for market participants.

- While markets generally rise over long periods, they do not rise every month, every year, or even every decade.

We believe:

- It is not necessary to bear the brunt of the worst market periods to benefit from the best.

- With careful quantitative modeling it may be possible to identify periods when risk outweighs reward in the market and exit, potentially protecting clients from extended down markets.

- The pain of significant loss outweighs the satisfaction of positive returns. Therefore, we seek to maintain equity market exposure while protecting from down markets.

The Lee Adaptive Model

*An individual sector score equals the sum of:

- the output of the market model multiplied by each sector’s estimated beta and

- the sector-specific factors scores

Market Factors

Estimates the outlook for the markets as a while and then calculates the impact of that market forecast on each sector. For example, a positive market outlook would have a greater impact on technology stocks than on utilities.

Sector Factors

Uses sector-specific factors, combined with Market Sentiment inputs, to generate a score for each sector. For example, a cheaper sector with positive momentum might have a stronger specific score than an overpriced one with negative momentum.

Lee Adaptive continues to be a strong performer in the US tactical allocation universe since its inception in 2015. Turnover can vary depending upon underlying market volatility.

In early April 2025, Lee Adaptive began exiting equities and raising cash. As of June 2025, the Lee Adaptive Large Cap Sector model is invested across several sectors including consumer staples, energy, financials, health care, materials, real estate, and utilities.

The Lee Adaptive Large Cap Sector Strategy is a strong tactical and defensive portfolio approach for concerned investors, and is currently available on Envestnet, as well as three LPL programs:

- Manager Select (MS)

- Model Wealth Portfolios (MWP)

- Personal Wealth Portfolios (PWP)