March 14, 2023

Chief Investment Officer, 3D, a Freedom Advisors company

“Remember the Golden Rule: He who has the gold, makes the rules.”

– Johnny Hart, writer of comic strip Wizard of Id

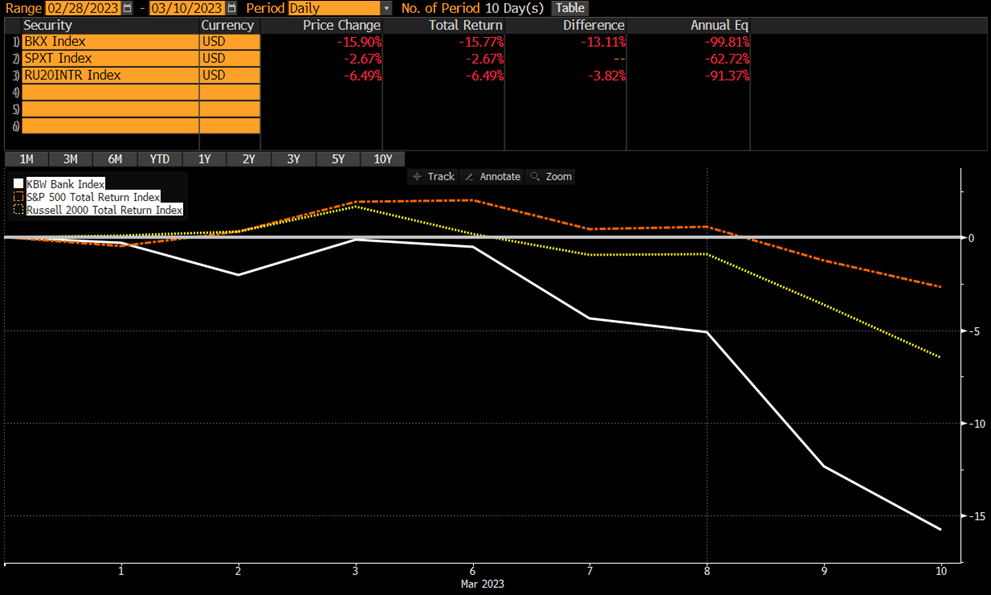

The events that led to this past week’s market sell-off, especially in U.S. bank stocks (Figure 1), reminded investors of the lagged effects from restrictive monetary policy (i.e. central bank rate hikes and the reduction of bank reserves through quantitative tightening). The market’s fixation on Fedspeak, such as Chair Jerome Powell’s testimony in front of Congress warning of higher-than-expected interest rate hikes, and on key economic releases, such as the employment payrolls report on Friday, was abruptly jerked toward the troubles that surfaced, seemingly out of nowhere, across smaller regional banks, notably SVB Financial Group, the holding company of Silicon Valley Bank (SVB).

Figure 1 – U.S. Banks Lead This Month’s U.S. Stock Market Sell-Off Over Concerns of Diminished Profitability and Regulatory Capital Pressures Stemming from Asset Losses.

Source: Bloomberg

Freedom Advisors clients can log in to access our full commentaries. Not a client? Contact us at 1-800-949-9936 or contact@freedomadvisors.com to get started.

Freedom Advisors offers a turnkey asset management platform (TAMP) with a complete portfolio management solution, comprehensive outsourcing of operations, and high-touch service to help advisors run efficient practices and deliver superior outcomes for their clients.

© Freedom Advisors. All rights reserved.