3D Investment Portfolio Models

3D Models

Investment Philosophy Rooted in 98 Years of Academic Research

Markets historically compensate investors for the risks they take – but a long-term time horizon is needed.

We don’t try to time the markets or find “mispriced” stocks. Instead, we trust the markets to be efficient. We research to understand and invest in risk factors that historically outperform over the long term.

It’s easy to get spooked by market downshifts and easy to think that actively playing the market is your best path to financial security, but short-sighted emotional reactions typically cost you in the long run.

Over the 20 years ending in 2018, the average equity fund investor underperformed the S&P 500 by 1.74% annually (DALBAR 2018 Quantitative Analysis of Investor Behavior).

We’re committed to seeking the rewards the equity markets have historically delivered over the long-term, but through the calm, disciplined approach of strategic investing.

ETFs: Low-Cost, Tax-Efficient

The structure of ETFs gives easy insight into their target market exposure, and a real-time gauge on their value. ETFs are also typically more flexible, cost-effective, and tax-efficient than other investment vehicles with:

Lower Expense

Ratios

and potentially higher

long-term returns.

No Cash Held to Pay

Shareholder Redemptions

so more of your money

is invested.

Greater Tax

Efficiency

so the investor decides when to

realize capital gains

Daily Fund Holding

Disclosure

for transparency in

what you own.

Each model portfolio and partner product we offer is rooted in academic research, a rigorous due diligence process, and factors in four key elements:

Investment Strategy

Strategic, Dynamic, Tactical—all three approaches can play a role, it’s about understanding how each strategy can fit within a portfolio.

- Strategic: A fixed asset allocation to equities and bonds

- Dynamic: The asset allocation is dynamically adjusted according to the macroeconomic environment

- Tactical: The asset allocation can be adjusted to the macroeconomic environment and can completely de-risk to 100% cash

Time Horizon

Return is a function of time. It is the ability to remain invested long enough so that the advantages of risk exposure are captured.

Risk Tolerance

Balancing investor goals with time horizon identifies the risk tolerance that will guide the strategy and keep the portfolio on track.

Downside Risk Management

Understanding how a strategy manages downside risk.

- Limited: Ability to manage at the sector and security level, outside defined parameters around a set equity/bond asset allocation

- Flexible: Ability to manage at the security, sector, geography, credit quality and asset allocation level

- Unconstrained: Complete control, including de-risking

We’ve simplified the portfolio construction process—not portfolio management.

It starts by establishing your client’s goals to set time horizon and return target.

We’ve made it easy for you to create customized portfolios that combine our in-house models with managers we have extensively due-diligenced to add skill without overlap—creating a full suite of products that can work alone or blended to create nuanced portfolios that meet client needs.

Our core belief is that risk will be rewarded over time, and that combining different approaches to investment management offers the best way to build bespoke portfolios for your clients. We do the construction for you—so you can spend your time advising clients and building your business.

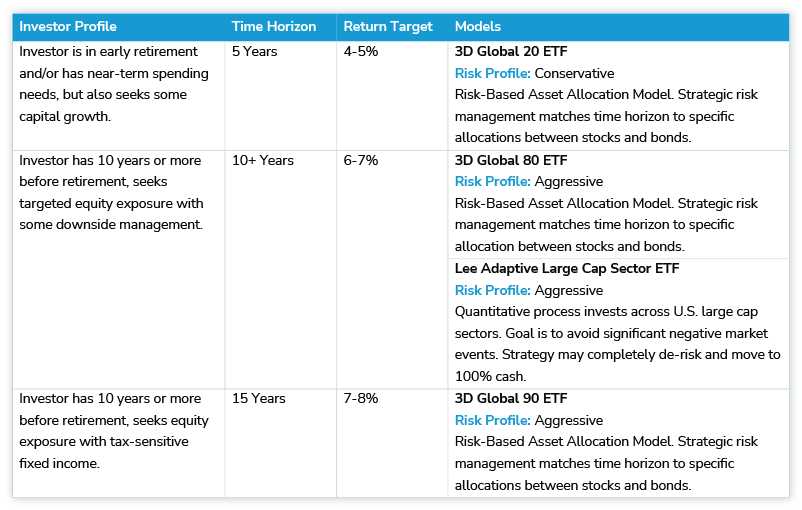

Mapping begins with a description of the client’s needs, which guides the portfolio composition.

Below are examples of three possible portfolios, based on client time horizon and return target:

3D Model Portfolios

We offer a full suite of asset management products, including specialty strategies that are easily deployed into custom client portfolios based on target return, time horizon and risk profile. We’ve made it simple to offer your clients fully diligenced, bespoke portfolios – so you can spend your time providing advice and growing your business.

3D Global Risk-Based Portfolios Using ETFs

Using exchange-traded funds (ETFs), we construct equity and fixed income portfolios into risk-based blends suited to a range of investors’ tolerances for risk. For instance, the 3D Global 60 portfolio consists of a 60% allocation to global equities and 40% allocation to fixed income – the 60/40 ratios remain constant and are periodically rebalanced to target.

3D Global Risk-Based Portfolios Using DFA Funds

Using Dimensional Funds (DFA), we construct equity and fixed income portfolios into risk-based blends suited to a range of investors’ tolerances for risk. For instance, the 3D Global 60 portfolio consists of a 60% allocation to global equities and 40% allocation to fixed income – the 60/40 ratios remain constant and are periodically rebalanced to target.

3D Targeted Fixed Income Strategies

Seeks low volatility, current income using ETFs to target a time horizon as specified by the vintage year in the portfolio (i.e. 2021). At the end of the time horizon, the fund is expected to be liquidated with net proceeds returned to investors.

3D Global Growth

Provide long-term superior risk-adjusted performance over a global market index like the MSCI All-Country World Index.

3D US Focused Equities

Provide long-term superior risk-adjusted performance over a U.S. broad market index like the S&P 1500 Composite.

3D ESG Strategies

Provide a stock portfolio more closely aligned with Environment, Social, and Governance (ESG) standards as measured by third-party research firms focused on assigning ESG ratings to individual companies based on their business practices.

3D Targeted Outcome

The portfolio is structured to offer participation in general equity market risk but with capped upside and downside participation depending on the underlying portfolio structure using exchange-traded fund (ETFs). The strategy benchmark is a 50%/50% blend of the S&P 500 Index (Total Return) and ICE/BAML 3-Month Treasury Bill Index.

Lee Adaptive Large Cap Sector Strategy

Lee Adaptive Large Cap Sector Strategy (“Lee Adaptive”) is a U.S.-only equity strategy that seeks to avoid exposure to severe market downturns while participating in up markets using an adaptive, proprietary quantitative model that adjusts its strategy and positioning as the tenor of markets evolve.

Value

Small Cap

Dividend

Quality

Low Volatility