Insights from PIMCO

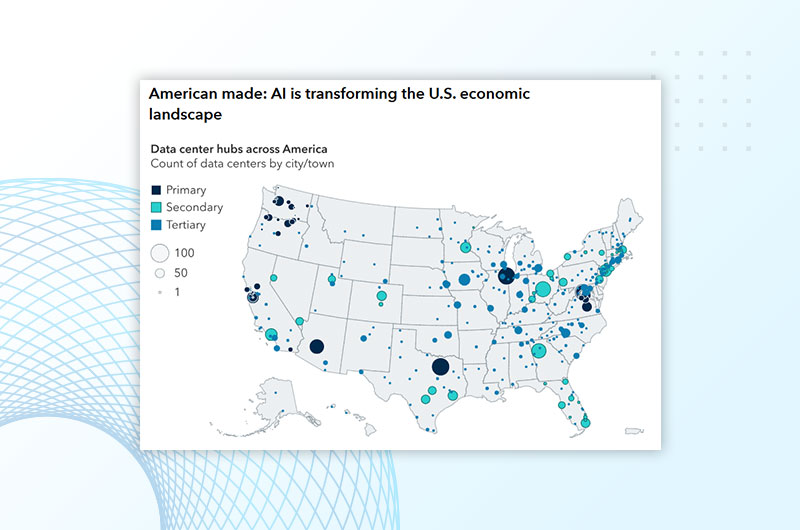

Has the AI stock rally run out of gas?

Insights from Capital Group

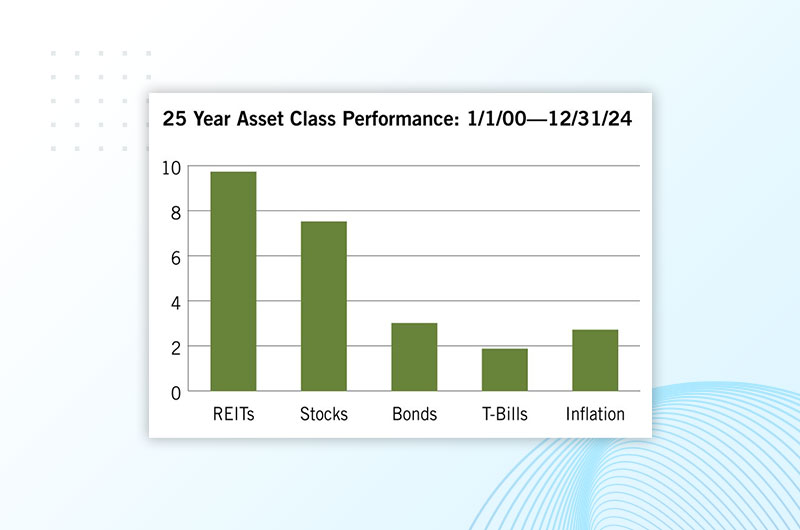

Real Estate: Are You in It?

Insights from Virtus Investment Partners

The Case for Active Management of Hedged Equity

Insights from Swan Global Investments

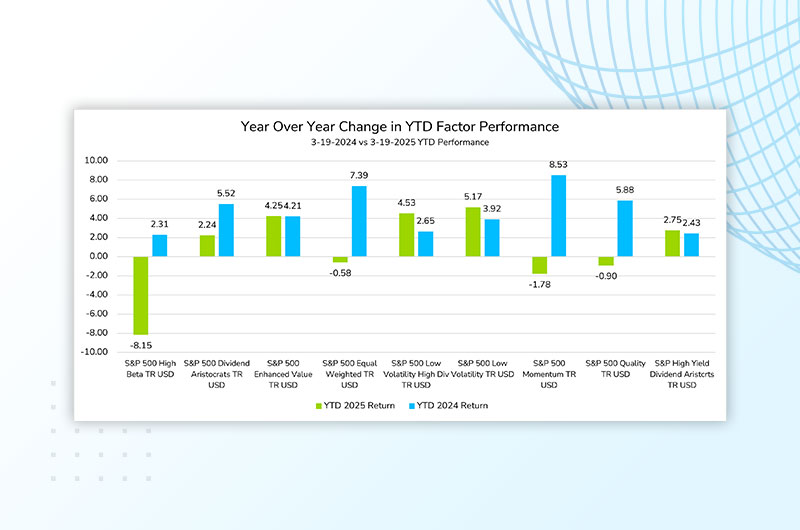

Factor Rotation: A Critical Moment to Reassess Portfolio Allocations

Advisors should proactively reassess portfolio allocations to ensure they are not simply reflecting past winners, but instead strategically positioned for what lies ahead

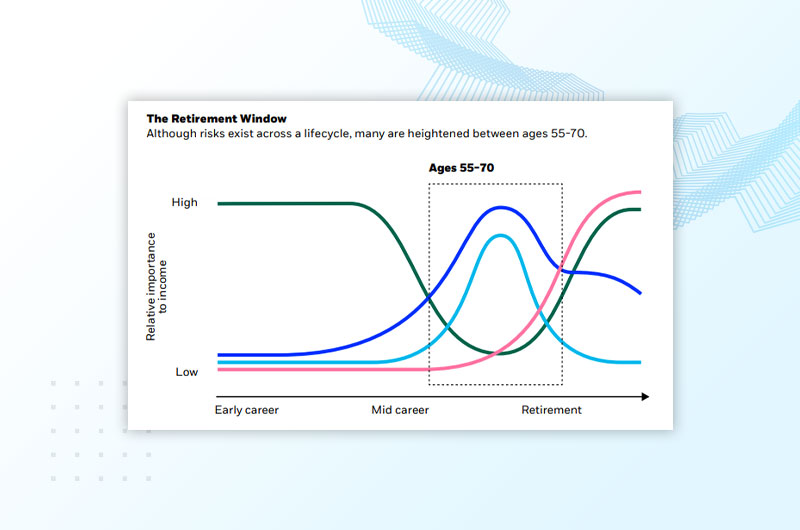

Navigating the retirement window: Introduce more certainty to outcomes

Insights from BlackRock

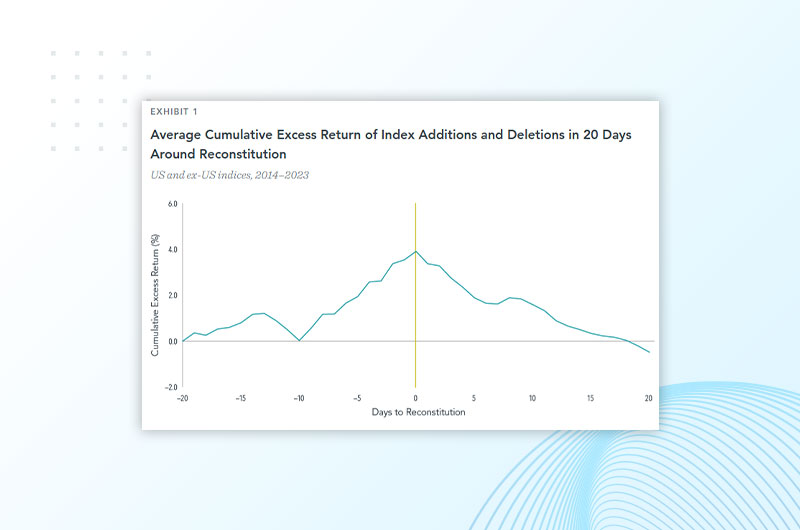

Measuring the Costs of Index Reconstitution: A Global Perspective

Insights from Dimensional Fund Advisors

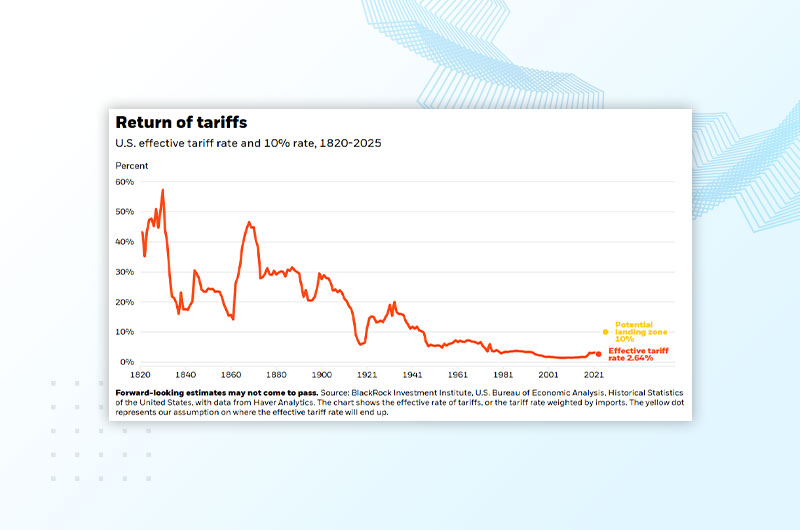

The Impact of Expected Tariffs on the U.S. Economy

This commentary examines the economic consequences and industry-specific impacts of tariffs, drawing from historical cases and empirical studies

Mag 7 Gravity

Insights from Dimensional Fund Advisors