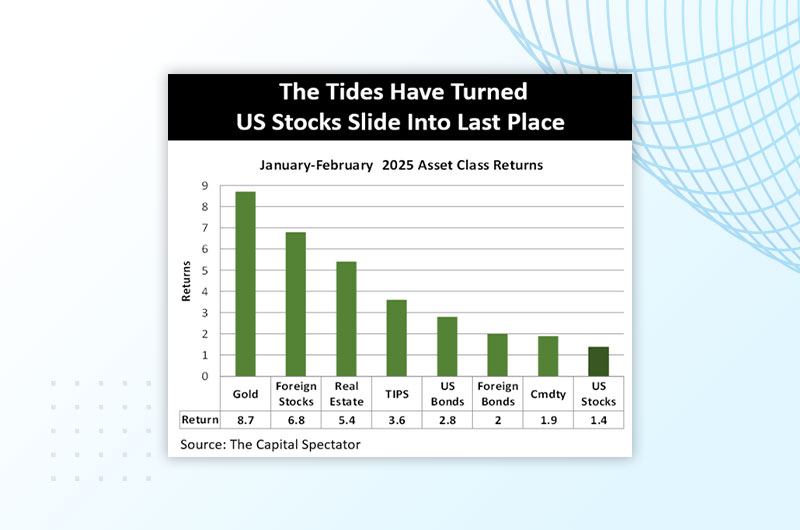

A growing body of market research suggests that diversification—particularly into European and other international markets—is becoming increasingly critical

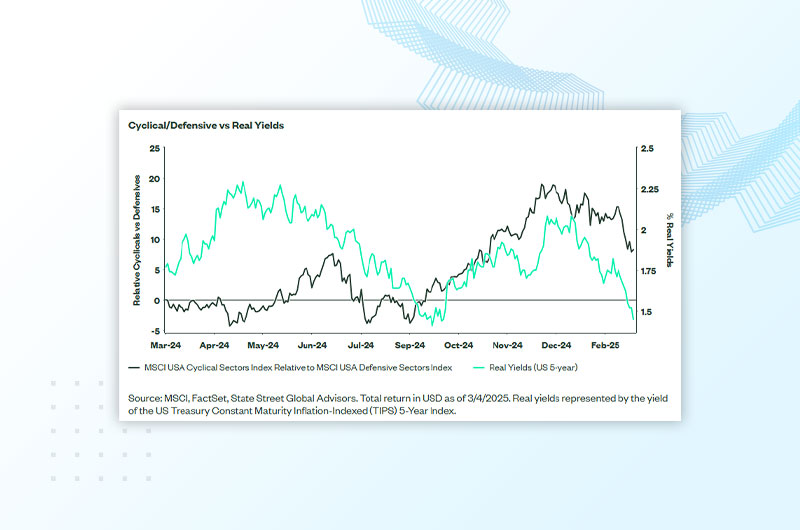

Inflation or Growth – Which One Is It?

Insights from State Street Global Advisors

Investing Can Be a Roller Coaster: Three Tips for Riding Out the Ups and Downs

Insights from Dimensional Fund Advisors

Key planning ideas to maximize your 2025 tax savings

Insights from Franklin Templeton

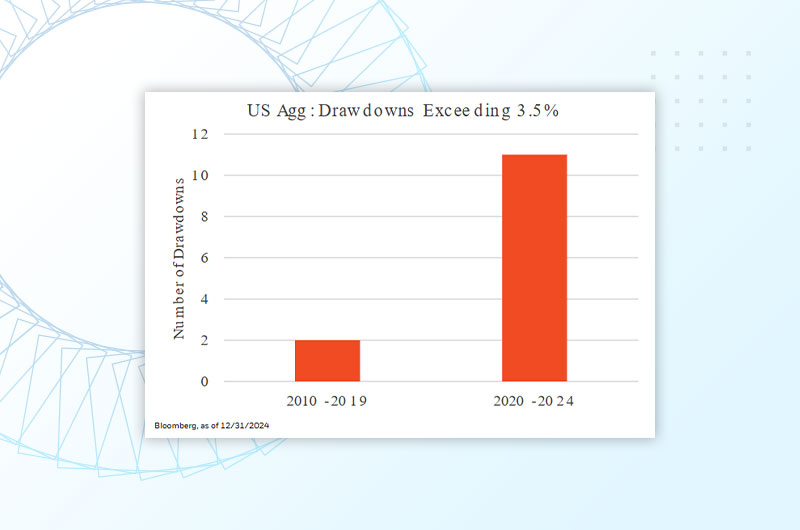

The New Role of Stocks and Bonds in 2025

Insights from BlackRock

ETF investing ideas for a soft landing in 2025

Insights from Invesco

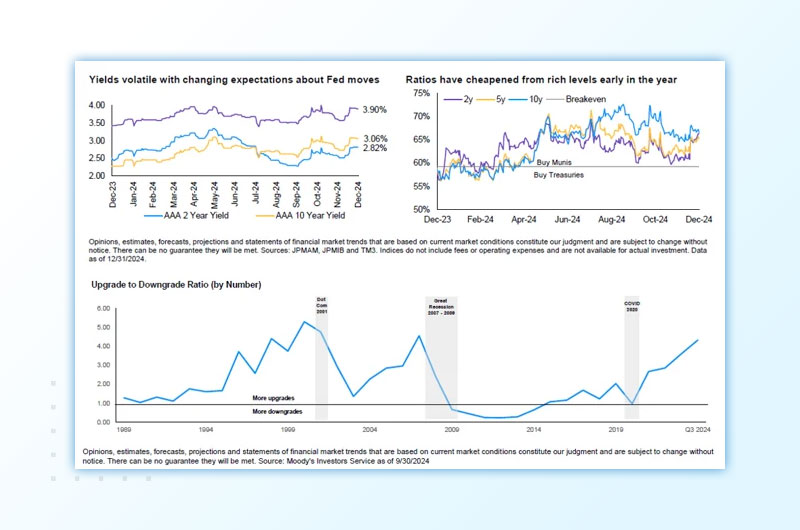

Munis Fair and (After-Tax) Attractive

The Freedom Advisors investment team met with JPMorgan Asset Management for an in-depth discussion on the current tax-exempt fixed income landscape

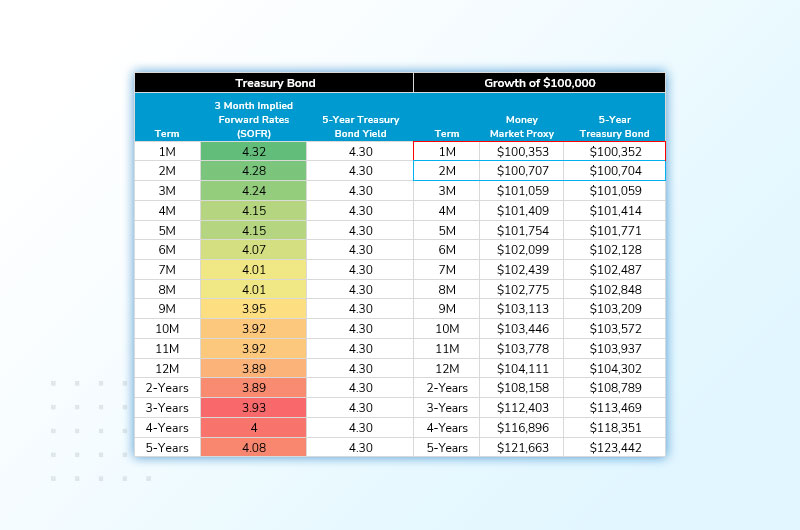

Pause for Longer as Inflation Progress Stalls

Locking in a lower rate for a few months compared to remaining in money market funds, despite comparable yields, can pay off over the long run

1Q 2025 Guide to Alternatives

Insights from J.P. Morgan Asset Management