Anna Nerys of BlackRock briefly discusses 3 compelling 2025 themes for advisors to consider and specific actions to take

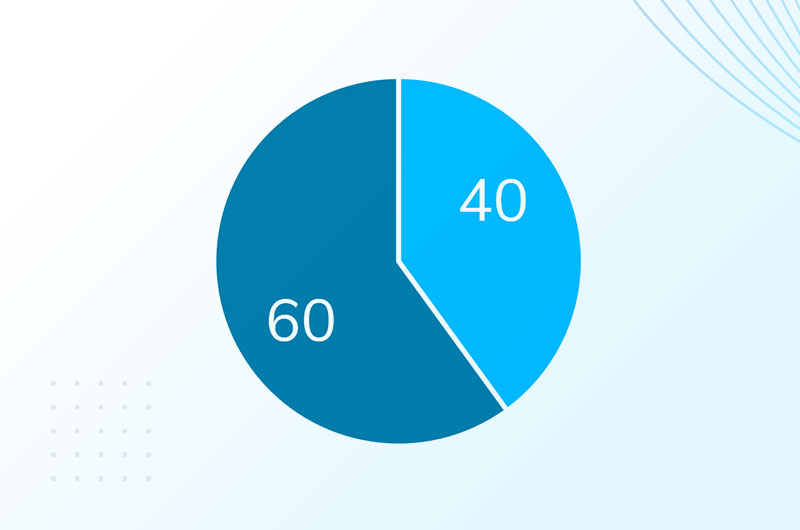

The 60/40 Debate: Why 70/30 Isn’t the Answer

Without proper management and regular rebalancing, what began as a moderate 60/40 allocation may now resemble a more aggressive 70/30

Freedom 2025 Outlook

As we enter 2025, the interplay between elevated valuations, shifting monetary policies, and geopolitical uncertainties underscores the necessity of disciplined

From Cash to Bonds: A Strategic Shift in Post-Pandemic Investing

According to PIMCO, the combination of high starting yields and anticipation for lower rates creates an attractive outlook for a wide variety of bonds. Investors lingering in cash may want to consider fixed income

Diversify with Confidence: First Trust Alternatives Model

With its thoughtful design and flexible strategy, the First Trust Alternatives Strategic Focus ETF model continues to prove itself as a leader in delivering alternative investment solutions for modern portfolios

Which area within equities will be the top performer in 2025?

Insights from Neuberger Berman

BlackRock – Near Term Assessment and 2025 Outlook

BlackRock senior portfolio managers and investment executives gathered for two days to debate the outlook for economies and markets

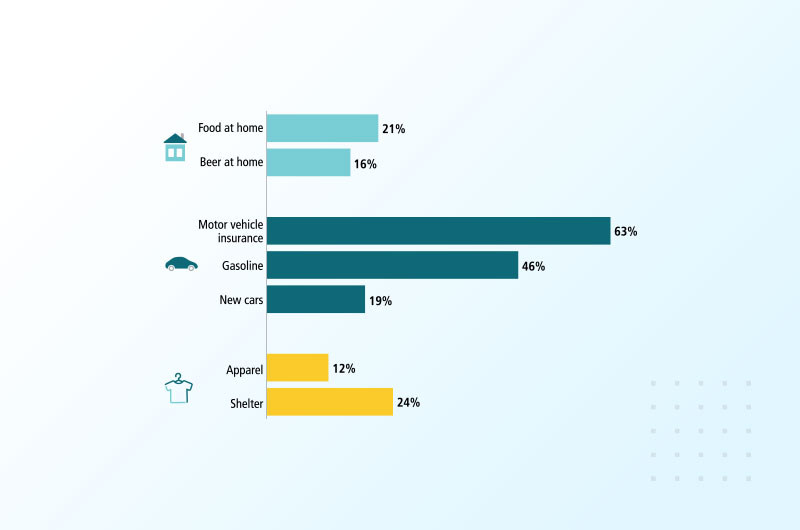

Invesco – Major Forces Driving Markets From New Administration

In this short piece Invesco focuses on the policies that could have the biggest impact on the economy and markets

Fixed income and AI: Active risk-taking amid higher rates

Insights from Vanguard